Mobile Banking

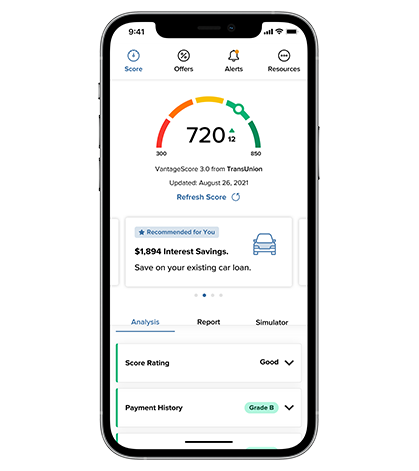

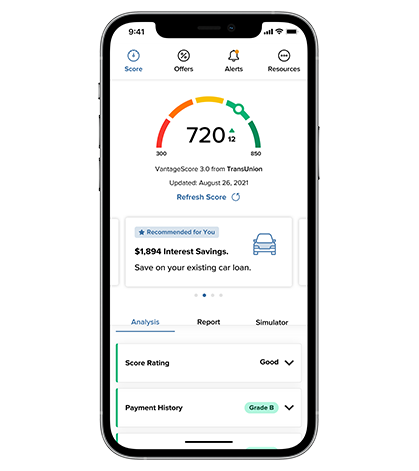

Staying on top of your credit has never been easier.

Access your credit score, full credit report, credit monitoring, financial tips, and education. All of this without impacting your score in your mobile app.

| Mobile | |

| Card controls | |

| Card controls | Mobile App |

| Credit score monitoring | |

| Credit score monitoring | Mobile App |

| Bill Pay | |

| Bill Pay | Mobile App |

| Mobile deposit | |

| Mobile deposit | Mobile App |

| Alerts | |

| Alerts | Mobile App |

| Transfer funds | |

| Transfer funds | Mobile App |

| View account balances | |

| View account balances | Mobile App |

| Multifactor authentication | |

| Multifactor authentication | Mobile App |

Access your credit score, full credit report, credit monitoring, financial tips, and education. All of this without impacting your score in your mobile app.

Learn how to check and modify your accounts, transfers, payments, alerts, and more, all in one app.

Powerful card management tools right in our app.

Learn how to set alerts for transactions and protect yourself from fraud.

Learn how to set controls on your debit card for locations, merchant types, transaction types, and spend limits.

Learn how to add travel plans into our mobile app.

Learn how to deposit checks from your phone into the account of your choosing.

Get spend insights, manage controls and alerts, see recent transactions, and more.

You can access any account you have set up in online banking. You select which accounts you want to access using Mobile Banking during the enrollment process.

Yes, the Mobile Banking App and CCFBank Mobile Deposit services utilize best practices from online banking, such as HTTPS, 128-bit multi-layer encryption, password or multi-factor authentication access, and application time-out when your phone is not in use. In addition, no account data is ever stored on your phone and if your phone is lost or stolen, access to your accounts can be disabled by calling the Customer Service Department at 800-590-9920.

We also recommend the following tips to increase Mobile Banking/Capture security:

Lock your device with a password or PIN when it is not in use.

Do not store personal information including your Access IDs and passwords on your phone or send them via email or text messages which could be intercepted

Only download applications from trusted sources. Make sure to download updates regularly, as updates often fix security flaws.

Do not enter personal information unless there is an “s” after http, which indicates the site is secure. Also look for security symbols like the lock icon.

Do not bank or shop online when using unsecured, public Wi-Fi access.

Do not click on any links in emails claiming to be from CCFBank. Instead go to the Bank website directly and log in.

Always log off completely after using Mobile Banking.

No. Mobile Banking does not save any files with personal or financial information on your mobile device. That information stays strictly within online banking. Some phones (e.g., Android) have logo and branding files that are copied to the mobile device. Those files do not contain any personally identifiable information.