Spring Break and CCFBank® have something in common – they both originated in 1938.

According to onlineschools.org, the concept of spring break began in 1938 with a swim forum event in Ft. Lauderdale, Florida. By around 1960, however, students began to go to the town in large numbers, and local businesses took advantage of this influx by offering specials such as all-you-can-drink beer for $1.50.

Vacations can be expensive. Especially ones that require a flight, hotel, and car rental. Many people believe the only way to travel is if you save up enough money throughout the year. While saving and budgeting for a vacation is recommended, there are additional ways to afford traveling without needing to break the bank.

Let’s breakdown how your debit card can help pay for your next vacation adventure:

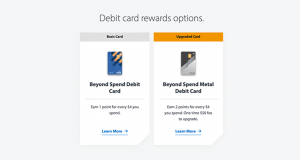

Open a Beyond Spend account and activate your debit card with uChoose rewards. You earn 1 point for every $4 you spend. Upgrade to a metal debit card and you earn 2 points for every $4 you spend.

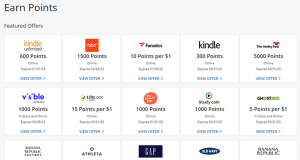

You earn points by activating offers on places to spend your money. You can activate those offers through our mobile app or online at the uChoose Rewards website. These points will be added to your account after a valid purchase using your debit card.

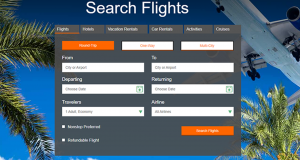

After your points have accrued, you can redeem those points for travel discounts on flights, hotels, vacation rentals, car rentals, activities, and cruises. You can search for different discounts depending on where and what you want to do. Each travel discount will show how many points it takes to redeem that offer. The more points you have, the more travel discounts you’ll be able to receive.

Enjoy your spring break trip and your new account with CCFBank!